Accounts Receivable Journal Entry Example

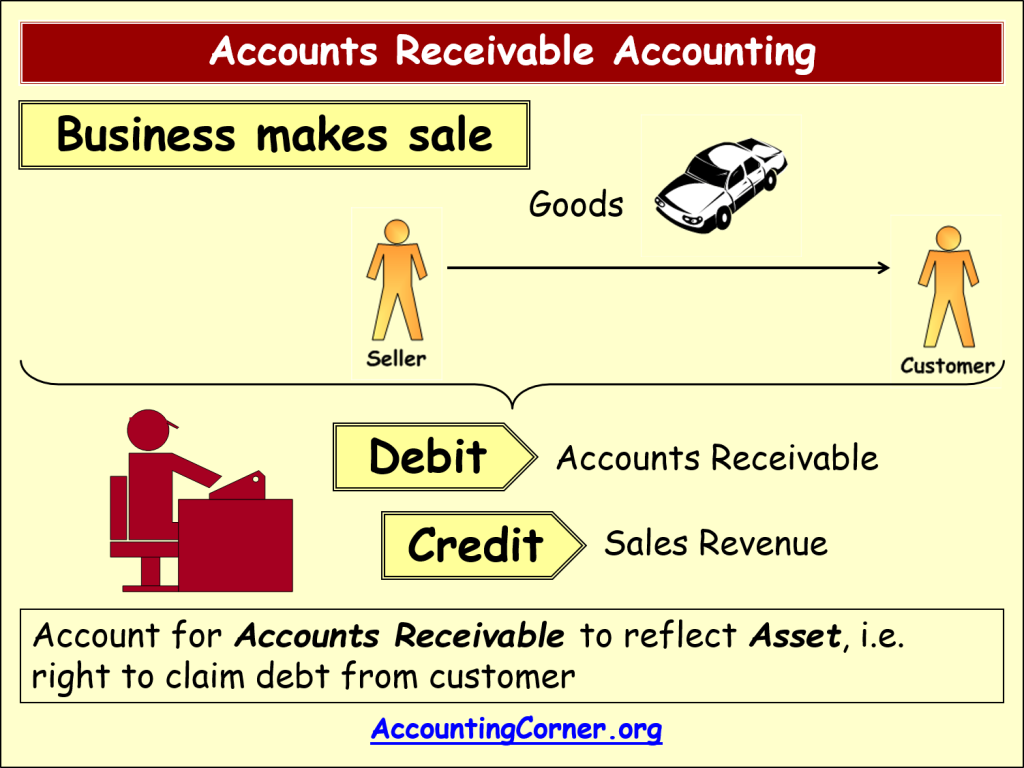

The Accounts Receivable process is the set of steps a business follows to invoice a client and collect payment. It’s essential for managing a smooth transition from sales to revenue and ensuring that a business maintains a healthy cash flow. Accounts Receivable, or AR, is the record of funds that customers owe to a business for goods or services rendered.

- The amount of money owed to a business from their customer for a good or services provided is accounts receivable.

- Additionally, accountants disclose the net amount of cash that is expected to be collected, as well as any collateral agreements.

- When Lewis Publishers makes the payment of $200,000, Ace Paper Mill will increase the Cash Account by $200,000 and reduce Debtors or Accounts Receivable Account by $200,000.

- Typically, you’ll separate the different types of assets listed on your balance sheet, identifying current assets, fixed assets (e.g., land, buildings, equipment), and other (often intangible) assets.

- Collection agencies often take a huge cut of the collectible amount—sometimes as much as 50 percent—and are usually only worth hiring to recover large unpaid bills.

- This estimate is then recorded as allowance for doubtful accounts and is used to offset accounts receivable.

Accounts receivable turnover ratio – what it is and how to calculate it

The magic happens when our intuitive software and real, human support come together. Our team is ready to learn about your business and guide you to the right solution. The goal is to have a lower percentage of Accounts Receivable remain open. Tracking this metric can help businesses assess areas where it can improve its Accounts Receivable process.

Company

Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line item is categorized as a current asset on the balance sheet. If your accounts receivable balance is going up, that means you’re invoicing more. If the balance is going down, that means you’re collecting customer payments from previous invoices. The accounts receivable turnover ratio is a simple financial calculation that shows you how fast your customers are at paying their bills. Accounts Receivable Open, or AR Open, measures how many ongoing Accounts Receivable a business has in a given period.

Step 3 of 3

In this journal entry, both total assets on the balance sheet and total revenues on the income statement increase by $200 on July 10. In this journal entry, total assets on the balance sheet as well as total revenues on the income statement increase by the same amount. There are a few big advantages to managing your accounts receivable effectively.

Automating your invoice process can help guarantee prompt and accurate invoicing. To begin the ordering and Accounts Receivable process, a customer will place an order that needs to be approved by the business. Once the company receives and approves this order, it generates a sales order which includes details about quantity, price, payment date, and any other relevant terms of sale. Because they represent funds owed to the company (and that are likely to be received), they are booked as an asset. A receivable is created any time money is owed to a business for services rendered or products provided that have not yet been paid for. For example, when a business buys office supplies, and doesn’t pay in advance or on delivery, the money it owes becomes a receivable until it’s been received by the seller.

Document your process

To record this transaction, you’d first debit “accounts receivable—Keith’s Furniture Inc.” by $500 again to get the receivable back on your books, and then credit revenue by $500. If you do business long enough, you’ll eventually come across clients who pay late, or not at all. When a client doesn’t pay and we can’t collect their receivables, we call that a bad debt. There are a variety of commonly accepted payments for small businesses, including e-transfer, ACH, credit, debit, check, and online payments.

JT had to settle another large liability in April which resulted in it not being able to pay the remaining invoice amount (i.e. $100,000) by 30 May. On 1 June, JT CFO convinced SS finance team to accept a note receivable due within 60 days carrying interest rate of 5% per annum for the remaining outstanding balance. JT paid the interest and principal of the note receivable at its maturity. Schedule a demo to observe how our Smart Chasing technology can make your dunning efforts consistent and seamless, spanning email, text, phone, and more.

Hence, the company might need to estimate the uncollectable amount which is called “allowance for doubtful accounts”. This journal entry is made to eliminate (or reduce) the receivables that the company has previously recorded in its account. A typical estate tax return aging schedule groups invoices by their number of days outstanding, such as 0-30 days, days, days, and over 90 days. Remember that the allowance for uncollectible accounts is just an estimate of how much you won’t collect from your customers.

Bir cevap yazın

Yorum yapabilmek için giriş yapmalısınız.